To determine whether it’s better to rent or buy a home, you can use a financial calculator that considers various factors. Below is a comparison of the pros and cons of renting versus buying, along with key factors to consider when making your decision.

| Factor | Renting | Buying |

|---|---|---|

| Initial Costs | Lower upfront costs (security deposit, first month’s rent) | Higher upfront costs (down payment, closing costs) |

| Maintenance Costs | Landlord typically covers maintenance | Homeowner responsible for all maintenance |

| Monthly Payments | Typically lower and more predictable | Higher, but builds equity over time |

| Flexibility | Easier to move; lease terms are usually short | More commitment; selling can take time |

| Tax Benefits | No tax benefits | Mortgage interest deduction available |

| Equity | No equity built | Builds equity over time |

| Market Risk | Less exposure to market fluctuations | Subject to market value changes |

| Investment Potential | No investment in property | Potential for property value appreciation |

Key Considerations

- Duration of Stay: If you plan to stay in one place for a long time, buying may be more beneficial. Renting is often better for short-term living situations.

- Financial Stability: Assess your financial situation, including income stability, savings for a down payment, and ability to cover unexpected expenses.

- Market Conditions: Research the local real estate market. In some areas, buying may be more advantageous due to rising property values, while in others, renting may be more cost-effective.

- Lifestyle Preferences: Consider your lifestyle. If you value flexibility and mobility, renting might be the better option. If you prefer stability and the ability to customize your living space, buying could be more appealing.

- Investment Goals: Think about your long-term financial goals. Buying a home can be a good investment, but it also comes with risks.

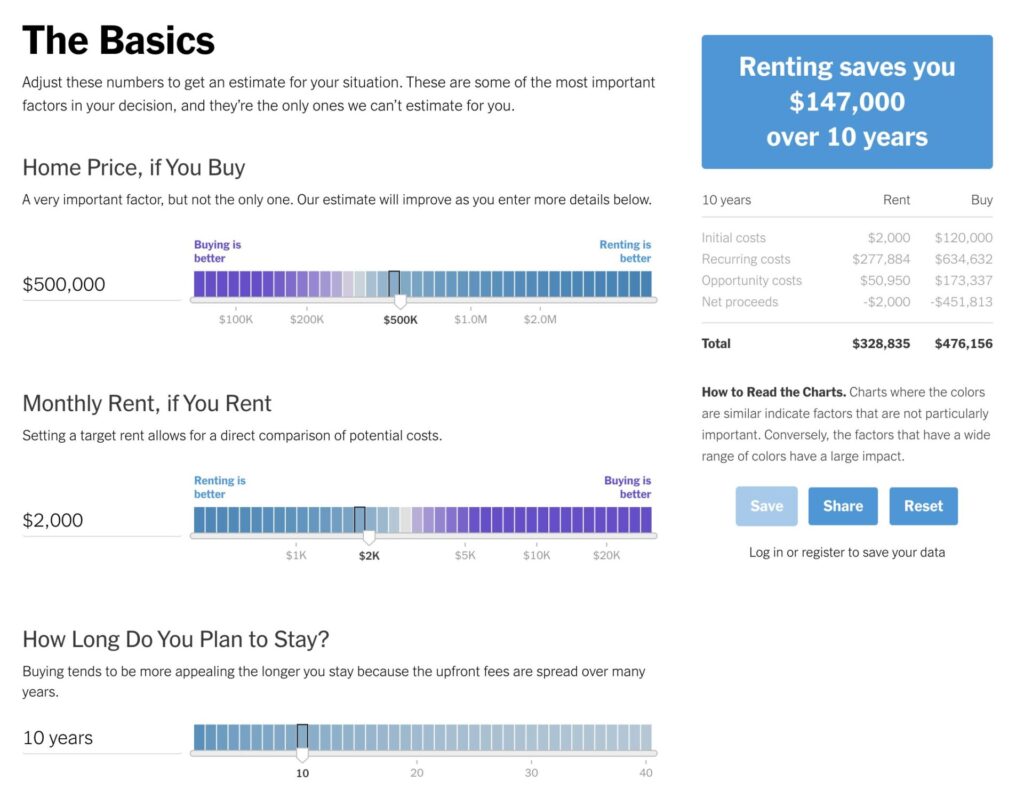

Using a financial calculator can help you input specific numbers related to your situation, such as home price, mortgage rate, property taxes, and expected appreciation, to see a more personalized analysis.