Short Term Rental Market Report: Experts Go Over Stats & Look Ahead to 2023

Table of Contents

The Future of Short Term Rental Market In 2023

As the world emerges from the pandemic and travel restrictions ease, the short-term rental market is poised for growth in 2023. However, this growth is likely to be uneven, shaped by various factors such as the pace of vaccination, the state of the economy, and the changing preferences of travelers. To help you navigate this complex landscape, we’ve compiled some predictions for the short-term rental market in 2023.

Increased demand for domestic destinations

As the pandemic has made many people wary of international travel, more travelers are expected to seek out domestic destinations for their vacations. This trend will likely benefit short-term rental hosts in popular tourist regions like beach towns, national parks, and small towns with unique attractions.

In addition, hosts who can offer personalized experiences, such as local tours or cooking classes, may also gain an edge over more generic options.

Continued adoption of technology

The pandemic has accelerated technology adoption in the short-term rental industry as hosts and guests seek contactless solutions and efficient communication. In 2023, we expect to see even more innovative technology uses, such as AI-powered pricing algorithms, virtual tours, and smart home devices, that can enhance the guest experience while reducing the workload for hosts.

However, hosts who rely too much on technology and ignore personal interactions may risk losing loyal customers who value human connection.

Pressure from regulations and competition

As the short-term rental market grows, it faces increased scrutiny from regulators and competitors. Local governments may impose more restrictions on short-term rentals, such as zoning laws, occupancy limits, and tax requirements, which could affect hosts’ profitability and compliance.

Moreover, traditional hospitality players, such as hotels and resorts, are also entering the short-term rental market, offering more upscale and standardized options that may appeal to some guests.

Hosts adapting to these challenges by staying informed, building relationships with stakeholders, and differentiating their offerings may be better positioned for success.

Emphasis on sustainability and social responsibility

As more travelers become aware of their choices’ environmental and social impacts, there is a growing demand for sustainable and socially responsible short-term rentals.

Hosts demonstrating their commitment to eco-friendly practices, such as recycling, energy conservation, and local sourcing, may attract more environmentally conscious guests. Similarly, hosts who support local communities, such as donating a portion of their revenue to a charity or hiring local staff, may appeal to guests who value social impact.

READ RELATED ARTICLE

The short-term rental market in 2023 is likely to be shaped by a range of factors, from global trends to local regulations, and from technology to sustainability. Hosts who can anticipate and adapt to these changes, while staying true to their unique strengths and values, may thrive in this dynamic industry. At the same time, guests who can choose wisely among the diverse options available, based on their own priorities and preferences, may enjoy memorable and rewarding experiences. Whether you are a host or a guest, we hope this glimpse into the future of short-term rentals has inspired you to explore the possibilities and seize the opportunities.

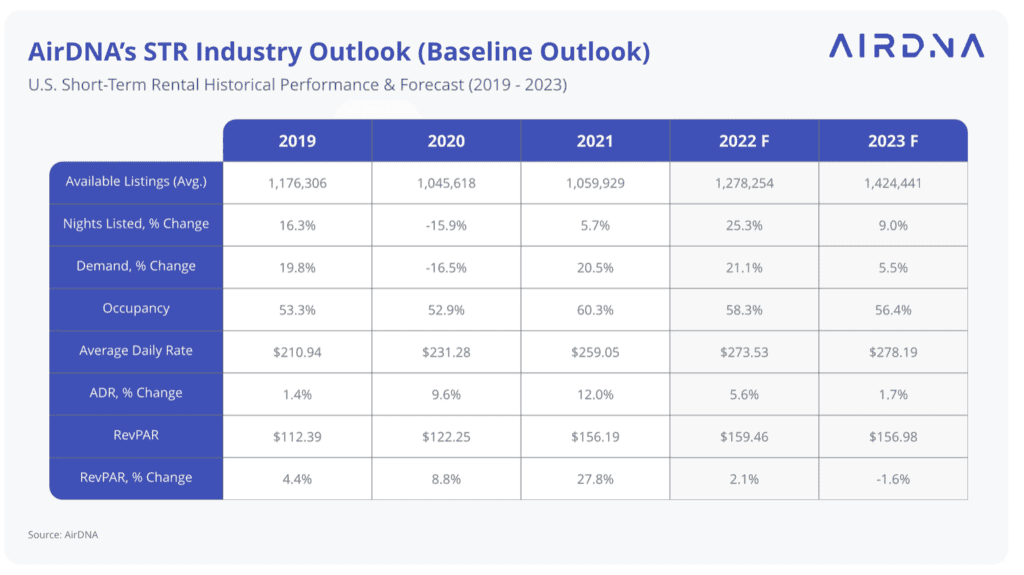

Short Term Rental Market Report By AIRDNA

Greetings, dear readers! It brings me great pleasure to report that despite the economic uncertainties of the past year, the American short-term rental (STR) market is continuing its upward trajectory as we move further into 2023.

Following a successful holiday season, we saw a remarkable 21.9% increase in available listings (supply) compared to the previous year, with demand (nights stayed) growing by 14.5%.

Despite challenging circumstances, these figures demonstrate a clear trend of growth in the industry.

While occupancy rates have been on a downward trend since March 2022, this January saw a decline of only 1.3% compared to the same period last year, tied for the smallest year-on-year decline since March. For reference, the most significant decline in occupancy was 10.2% in June 2022, with a decline of 5.1% in November 2022.

Let’s take a closer look at some of the critical performance metrics from January 2023.

Revenue Statistics

According to AirDNA, revenue per available rental (RevPAR) rose by an impressive 1.7% year-on-year to $153. Available listings reached an astounding 1.33 million, representing a 21.9% year-on-year increase. Total demand (nights) also rose by 14.5% year-on-year, while occupancy rates declined by only 1.3% year-on-year to reach 49.9%, an increase of 3.6% compared to 2019. Meanwhile, average daily rates (ADRs) rose by 3.1% year-on-year to $311, and nights booked increased by 17% year-on-year.

ARTICLE SOURCE: AIRDNA

It is worth noting that ADR growth slightly slowed to 3.1% year-on-year in January from 3.4% in December. Despite inflation remaining high, with estimates by the Bureau of Labor Statistics (BLS) suggesting it was more than 6% through January, ADRs have decelerated across the board.

This trend may be due to recent positive economic news, including the January jobs report, which showed 517,000 newly added jobs, unemployment reaching lows not seen since the mid-20th century, and substantial personal income growth accelerating in the final months of the year. While the Federal Reserve has signaled its intention to continue raising rates, the most recent increase of 25 basis points was smaller than previous hikes and could be a positive sign for the future.

Booking Rates

Despite some economic uncertainties, booking rates remain strong. While demand growth in January was still high, the rate of new bookings declined slightly from December levels to 17%, down from 23.1%. However, booking rates, in combination with forward booking levels, are a leading indicator of future demand performance, which suggests the outlook for the industry remains optimistic.

In summary, despite ongoing economic uncertainties, the American short-term rental market has continued its upward momentum into 2023. This is evident from the impressive increase in available listings and total demand and the positive performance of RevPAR and ADRs.

While occupancy rates have declined slightly, the fact that the rate of decline has slowed is an encouraging sign for the industry’s future. With strong booking rates and positive economic indicators, it appears the short-term rental market is set for continued growth and success in the coming year.

The Opportunity is Still There

The short-term rental market in 2023 is likely to be shaped by a range of factors, from global trends to local regulations, and from technology to sustainability. Hosts who can anticipate and adapt to these changes, while staying true to their unique strengths and values, may thrive in this dynamic industry. At the same time, guests who can choose wisely among the diverse options available, based on their own priorities and preferences, may enjoy memorable and rewarding experiences.

Whether you are a host or a guest, we hope this glimpse into the future of short-term rentals has inspired you to explore the possibilities and seize the opportunities.

If you need more information on how to find a profitable shot term rental, simply call our team.

We are here to guide you every step of the way.